The people of Sri Lanka are good at chattering, Economics, politics and foreign affairs etc. But their speeches are mere fantasies. Sri Lanka was collapsed because of such empty nonsense.

Even someone who runs a village tea shop should be well aware of its income, expenses, and debt. If you do not understand those numbers, the tea shop will go bankrupt.The situation in a country is similar.

How many people know the actual numbers of Sri Lanka’s GDP, government revenue, government expenditure and debt?

Even the people’s representatives in Parliament know about it?

Those who delivering Lorry talk about the Sri Lankan economy do they knowing about these?

It is not surprising that the country goes bankrupt when the people delivering lorry talks and cast their vote without knowing the real situation in the country.

The situation in Sri Lanka is as follows

Gross National Product of Sri Lanka – USD 82

Government Revenue Rs. 228400 crore (Rs. 2284 billion)

Government Expenditure Rs. 524500 crore (Rs. 5245 billion)

Deficit 296 100 billion (Rs. 2961 billion)

Government revenue composition as follows

Non-tax revenue 8%

24% VAT

Excise duty 24%

Income Tax – 20%

Other tax 20%

Import duty 8%

Nature of Taxes – Direct Taxes 22%

Nature of Taxes – Indirect Taxes 78%

Government Expenditure composition as follows

36% interest payments

30% of wages and salaries

7% Other Goods & Services

4% Government Institutions and Corporations

23% Home Division

(2021) The total State debt at the beginning was Rs. 15117.2 billion, Local sources s Rs. 9931.7 billion, Foreign loan amount 6632.8

Government revenue per annum not sufficient to repay the loan installment

It is worthy to note borrowings under high interest rate are been used to pay the salaries of 1.6 million public servants, pensions of more than 500,000 , free education and health and development etc.

Foreign debt has soared to $ 55 billion. The domestic debt mountain has risen to 13 trillion rupees.

Further when dollar rises, foreign debt rises accordingly

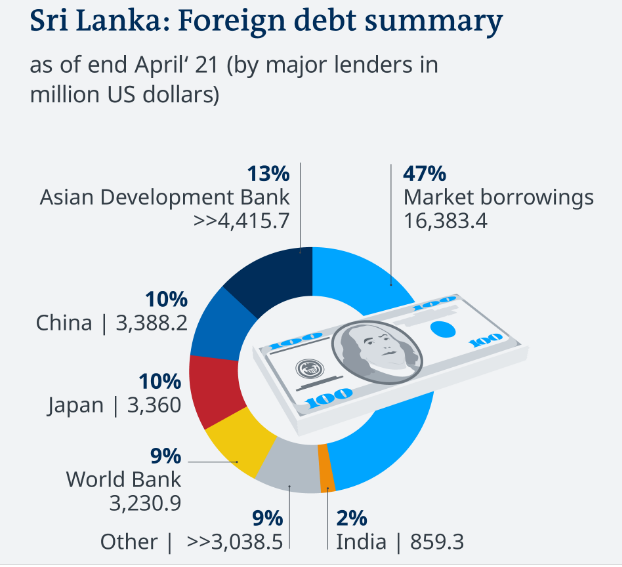

Foreign loans composition (See the attached image in this article )

Export earnings (US $ 12 billion)

Expenditure on imports (US $ 20 billion)

Difference between imports and exports (US $ 8 billion deficit)

Export direction as follows

United States – 25%

England – 9%

India – 6%

European Union – 23%

Import direction as follows

China – 22%

India 19%

UAE 6%

Singapore 5%

Foreign exchange

There are several sources of foreign exchange for Sri Lanka. These include export earnings, remittances from foreign workers, tourism earnings, earnings to the Colombo Stock Exchange, foreign direct investment, Treasury bills, bonds and long-term loans.

What is a sovereign debt default?

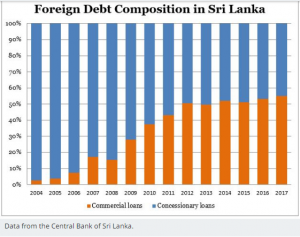

As mentioned above in this article, the government has borrowed 53% locally and 47% abroad. These loans and installments must be repaid regularly, whether local or foreign. However, a government does not face a serious crisis in repaying domestic loans. The reason is that ‘dollars are not needed to pay off domestic debt. The government can repay the loan by printing new currency or (in rupees). Problems and pressures are less here because the government does not care about inflation caused by the printing of new money.

However, the government should clearly pay off foreign loans in ‘dollars’. That is when the crisis arises.

According to economics, loans obtained by a ‘sovereign state’ are called ‘sovereign loans’. In particular, a government refers to ‘foreign exchange borrowing’ as sovereign debt. Accordingly, a guarantee will be given for the sovereign loans taken by Sri Lanka through foreign exchange. Such guarantees are through bonds. They are called sovereign bonds. At present our country has issued a large number of such bonds and obtained loans.

According to economics, sovereign default refers to ‘default or default on a loan taken by a sovereign state as it matures. Such a country is called a self-defaulting country otherwise sovereign debt default. Sri Lanka is such a country.