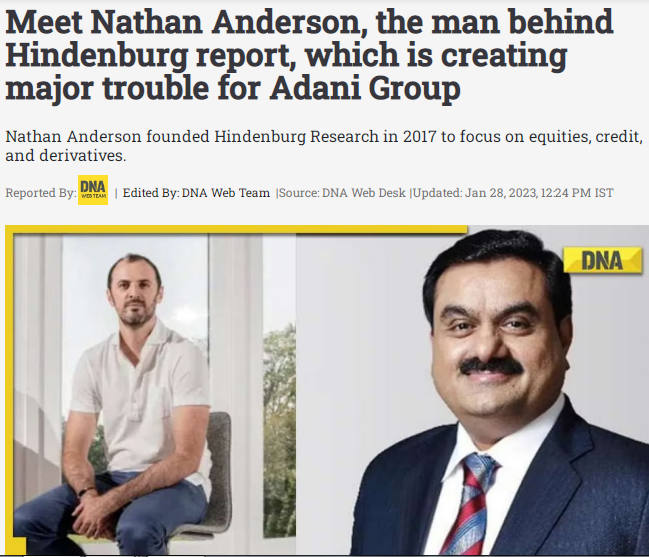

Adani was the second richest person in the world. But due to a report published on a website on 24 Jan 2023, he lost that position. The report against Adani was published by a website called www.hindenburgresearch.com run by Nathan Anderson. Due to the report against Adani, the loss in one night was 5.5 billion USD

The Hindenburgre search report is a simple one that anyone can understand. They have leveled 5 main charges against Adani, namely

1. Fraudulent stock transactions /Stock Manipulation

2. Accounting irregularities

3. Financial scams

4. High debt and poor liquidity

5. Adani, being an inflated figure of political authority

Adani has 7 main companies. Its net worth rose from USD 20 billion to USD 120 billion within 3 years. Hindenburgre has shown that such growth was achieved by artificially inflating the stock value up to 819%.

However, Adani has strongly denied the Hindenburg report. Nathan Anderson, the founder of the Hindenburg Institute, was an American of Jewish origin. He is a double player. Generally Nathan Anderson exposes the mistakes of listed companies. But he does not reveal them in good faith . Nathan Anderson is a white collar smuggler.

Nathan Anderson’s racket is connected with ‘short selling’ transactions. Short selling is a special type of transaction that can be seen in the stock market.

Generally, when the stock price goes up, an investor makes a profit. Short selling is a way for an investor to make a profit when the stock price goes down.

If an inverter is known for certain that the share price of a company is going down, what happen in this context is the shares are selling immediately at the determined high price and bought back as soon as the price falls. When the account is balanced at the day end , there will be a profit in the account.

Now Nathan Anderson’s racket and master mind brain can be understood. First he discovers some corruption in a prominent company. He knows that revealing the related corruption will affect the decrease in the company’s stock value. Accordingly, Nathan Anderson gets a big profit through Pre planned short selling transaction .

There is no room for short selling transactions in Sri Lanka. If short selling transactions are allowed, the Nathan Anderson role will be taken over by people like Dilith Jayaweera. However, short selling transactions should be introduced to Sri Lanka as well. Then those wolf who in the stock market with in the sheep clothing will be exposed.

See the table below how the stock value is artificially inflated